Real Life

Case Studies of Increase Billing Clients

- Recurring Billing and Decline Recovery

- Decline Alert System Saves MID

- Machine Learning Lowers Declines

- MID Manager Prevents Cap Overflow

- Intelligently Craft Dunning Process With Data

- Case Study of a Nutra Supplement Selling Client

- Case Study of Client in the Sport Training Niche

- Case Study of Client in the Network Processing Niche

- Case Study of Client Scared of Stripe

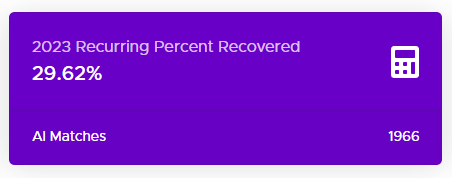

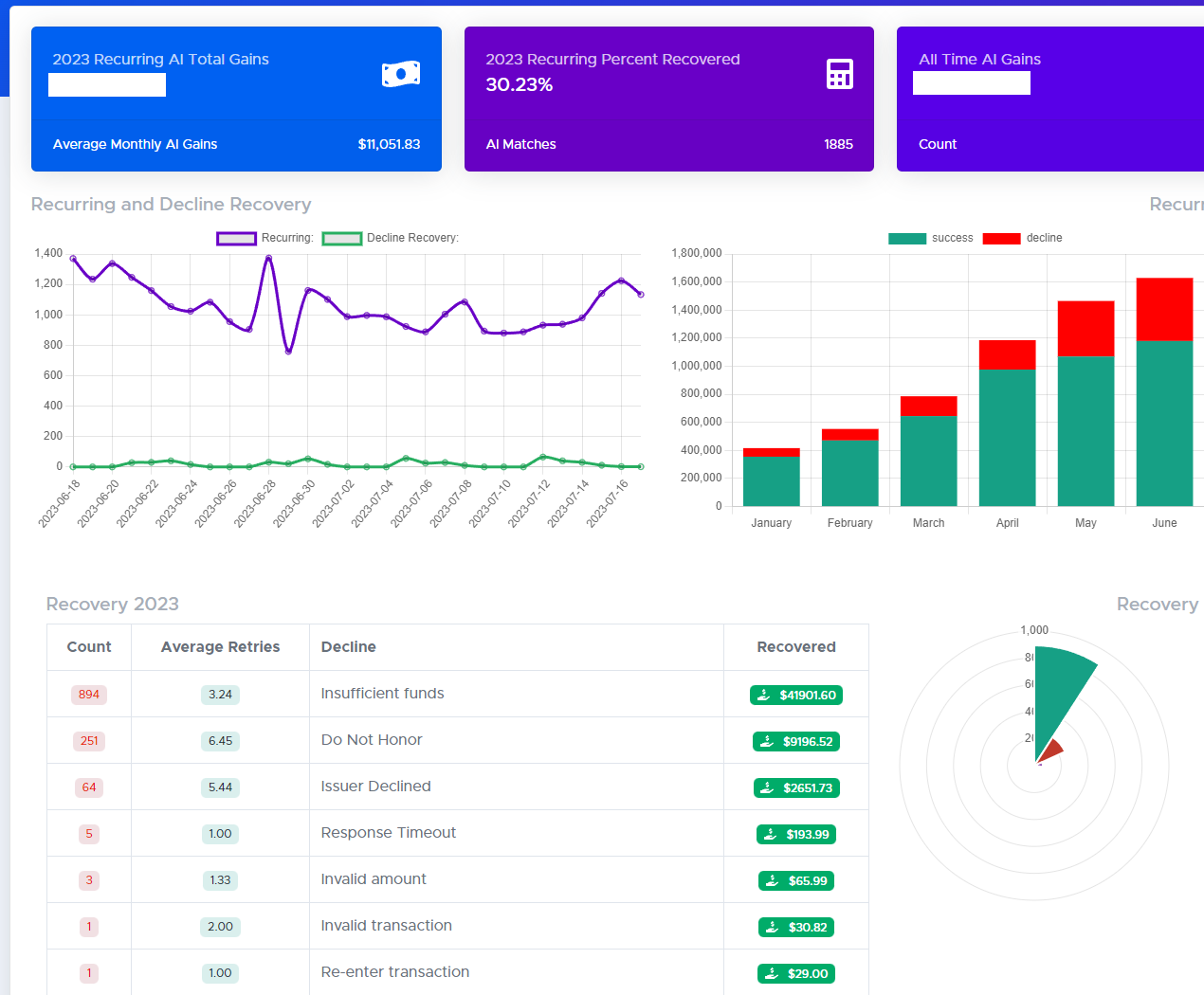

1. Recurring Billing and Decline Recovery

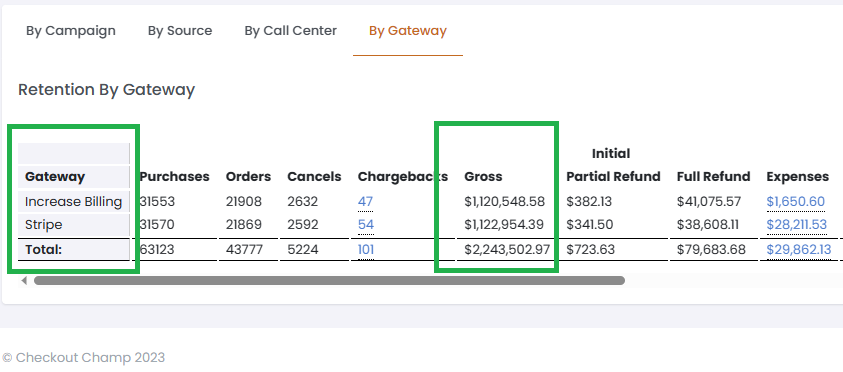

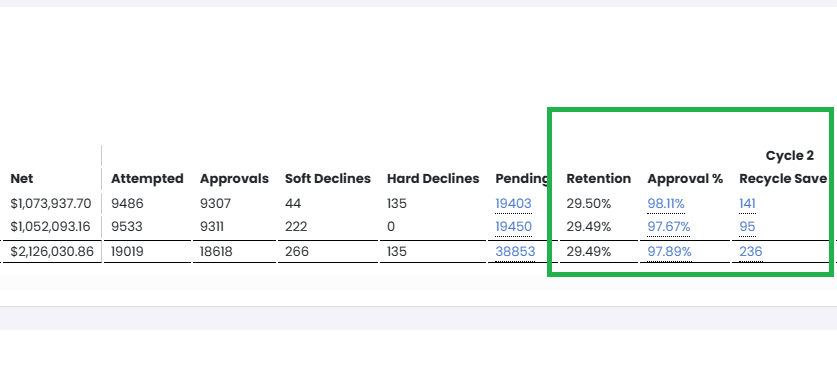

Increase Billing Decline Recovery process consistently winning, in this case on Cycle 2 Increase Billing is beating Stripe by 38.9% with 141 Increase Billing saves and 95 Stripe saves.

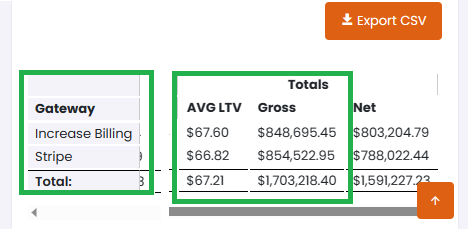

Customer runs a physical product funnel with a digital subscription component, after 1 year splitting transactions with Stripe in this funnel and equivalent transaction throughput not only does Increase Billing transaction fees win, but notice the retention and Recycle Saves of the membership.

Higher LTV than Stripe after Cycle 4 and $1.7M transacted through the recurring process.

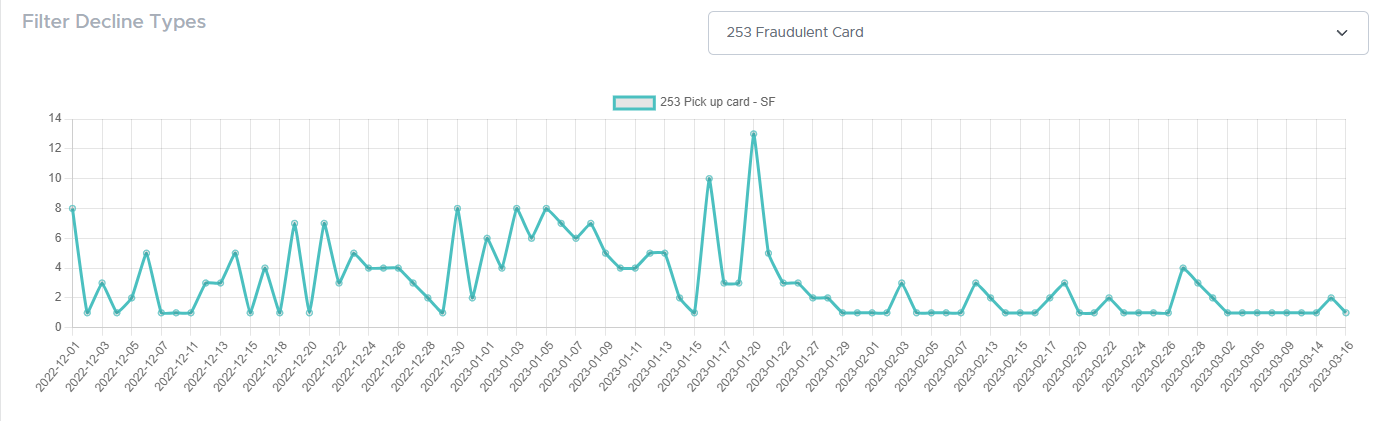

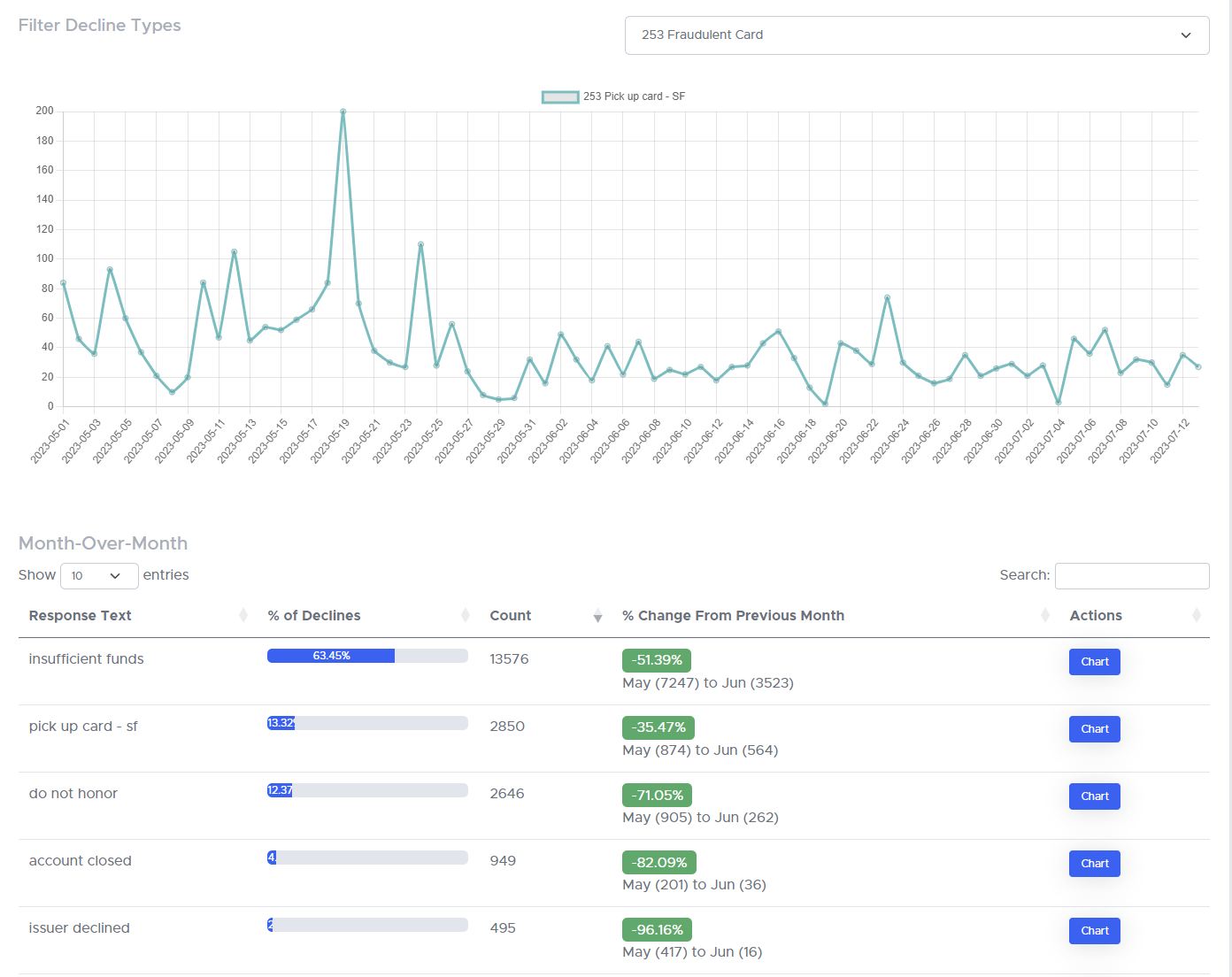

2. Decline Alert System Saves MID

Customer experiencing abnormally high Suspected Fraud declines in a newly added MID. Increase Billing system alerts the appearance of a statistically high decline type, our Merchant Account team takes up the issue with the processor and resolves the false-positive Fraud Decline. You can see the dramatic decrease in Suspected Fraud declines.

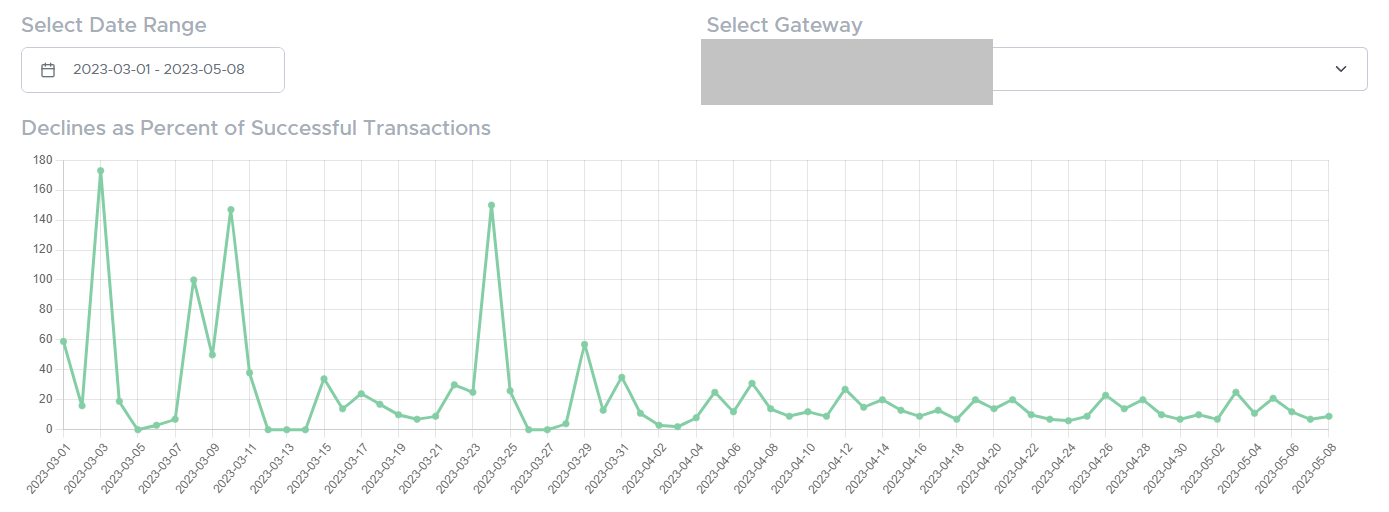

3. Machine Learning Lowers Declines

A new client imports transaction data into our system in Late March. After switching to Increase Billing note how the system lowered and smoothed out the declines as percent-of-sales by intelligently selecting the best MID for the transaction.

IncreaseBilling tools keeps you on top of transaction flow and results.

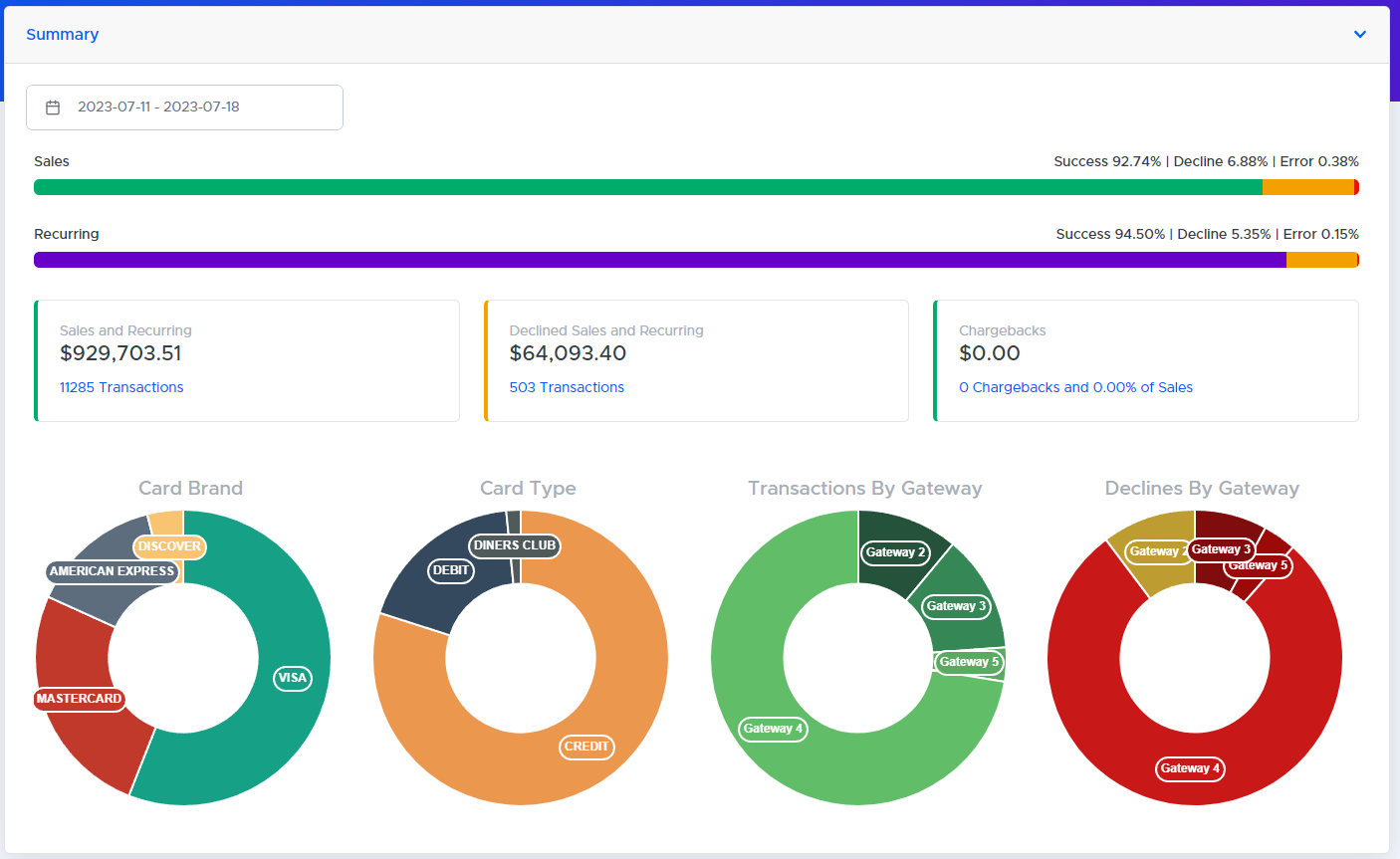

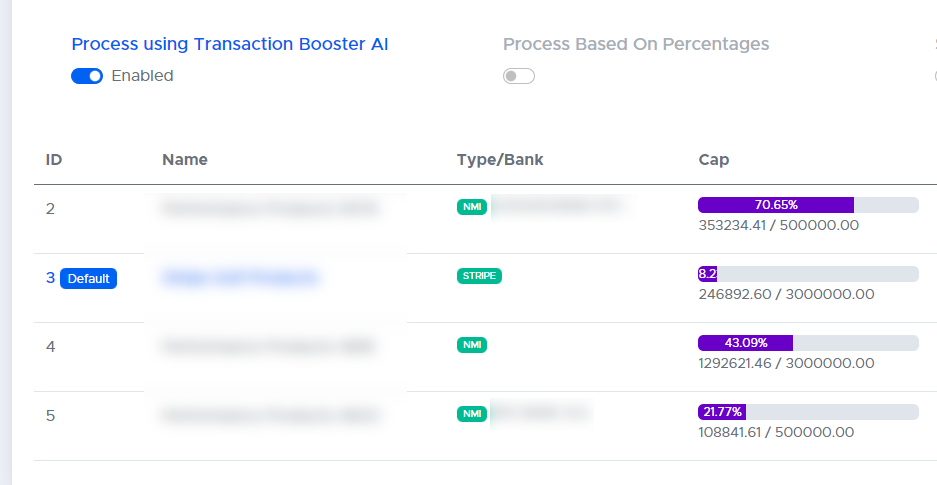

4. MID Manager Prevents Cap Overflow

During the onboarding process a new client discovers $65,000 in declined transactions attempted in a MID over the monthly cap.

IncreaseBilling monitors MID caps by the minute and will immediately migrate transactions to MIDs below the cap. Never worry about MID caps again!

5. Intelligently Craft Dunning Process With Data

Long-term client reduces costs and maximizes recovery by selectively retrying declines based on past performance, taking into account our trained database and their own customer data, they were able to dramatically reduce declines and transaction fees while maintaining MID health and high rate of decline recovery.

Client recovered over 30% of unique customer declines that previously they weren't able to recover.

6. Case Study of a Nutra Supplement Selling Client

- Initially had an outrageous decline rate averaging over 70% across 80+ MIDs

- Increase Billing analyzed their MIDs, identified several issues, and were able to decrease that down to 23%

- Client had a high rate of suspected fraud, which we were able to eliminate the majority of within days

- Client had a huge amount of past declines that they weren’t able to recover themselves and were on the verge of throwing out, but Increase Billing was able to save an additional 18% of those using our Recovery Process

7. Case Study of Client in the Sport Training Niche

- Helped client double their sales in the tens of millions of dollars within a short time

- Increased their approval rate to 97% on the front-end, as well as 95% on the recurring

- Analyzed their processing and helped save them multiple six figures a year

- Helped them get rid of unnecessary billing charges that saved them over $40,000 a month

- Saved over 30% of their declines that they initially failed to recover

- Identified an issue with their recurring processing where huge chunks of recurring weren’t previously going through correctly and went unnoticed until Increase Billing stepped in, which saved them over an estimated $1 million

- Created a safe and secure backup of millions of dollars in recurring revenue that would’ve been at risk otherwise

8. Case Study of Client in the Network Processing Niche

- Analyzed their processing and discovered tens of thousands of dollars in just the first month being missed due to merchant account issues

- Pointed out over $60k in lost revenue due to a 10 second fix with Increase Billing

- Estimated that they’d be saving up to $948,000 a year

9. Case Study of Client Scared of Stripe

Client was afraid to continue using Stripe due to the fact that there was a risk of them not being able to get their credit card data back if something went wrong, which would have jeopardized millions of dollars in recurring revenue that would just get killed instantly if that were to happen.

They were not only able to eliminate that risk through using Increase Billing, but they were also able to improve their transaction approval rating and save nearly a third of the declines that they weren't able to recover themselves!