Case Study:

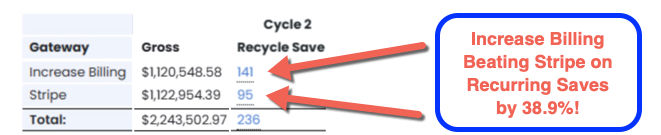

Increase Billing Beats Stripe's Decline Recovery by 38.9%

If you process any sales online, you know that declines are a huge issue.

What you probably don't know, especially if you're not paying really close attention to your transactional data, is that you're likely losing at least 15% to 20% of your revenue due to false declines (source: Visa and Mastercard). In some cases A LOT more than that (we've seen as high as over 60%).

In fact, it's estimated that businesses lose over $1.1 trillion (and growing) a year due to false declines (based on Statista's estimate of $6.3 trillion in online sales), and that up to 90% of declines are legitimate transactions that should be going through (source: Aite).

That's a lot of money. If you're doing a million a month in sales, that means you could be missing out on another million or two a year without even knowing it. And if you could get those orders through, that's another million you get without having to spend another penny more on advertising.

We can solve this problem in two ways: First, there's things that can be done ahead of time to prevent declines from happening in the first place. Second, when declines do happen, there's things that can be done to increase the likelihood of them going through afterwards without issues.

Furthermore, they also found that Increase Billing was able to get more front-end sales through, more recurring sales through, save more declines, and increase the lifetime value as a result of all of their sales.

If you're processing online and not being smart with the ever growing decline issue, you're just kissing money goodbye. Let us help you lower your declines, save more of your future declines, manage your MIDs / merchant accounts' health better and smarter, and reduce your processing risks now by scheduling schedule a free consultation HERE.